“I think I won the ‘ovarian lottery’,” says Bridge founder and CEO Lalit Janak, referencing Warren Buffett’s famed metaphor for the power of circumstance in determining one’s path. “I’m lucky — I was born in the right place, at the right time, with opportunities afforded to me through no effort of my own. Most of the world doesn’t get that chance.”

Despite coming from humble beginnings, Lalit nevertheless recognized this fundamental inequity in the pre-determinative power of circumstance, and was determined to find a way to change it — by creating a business designed specifically to help lower income communities begin their wealth-building journey.

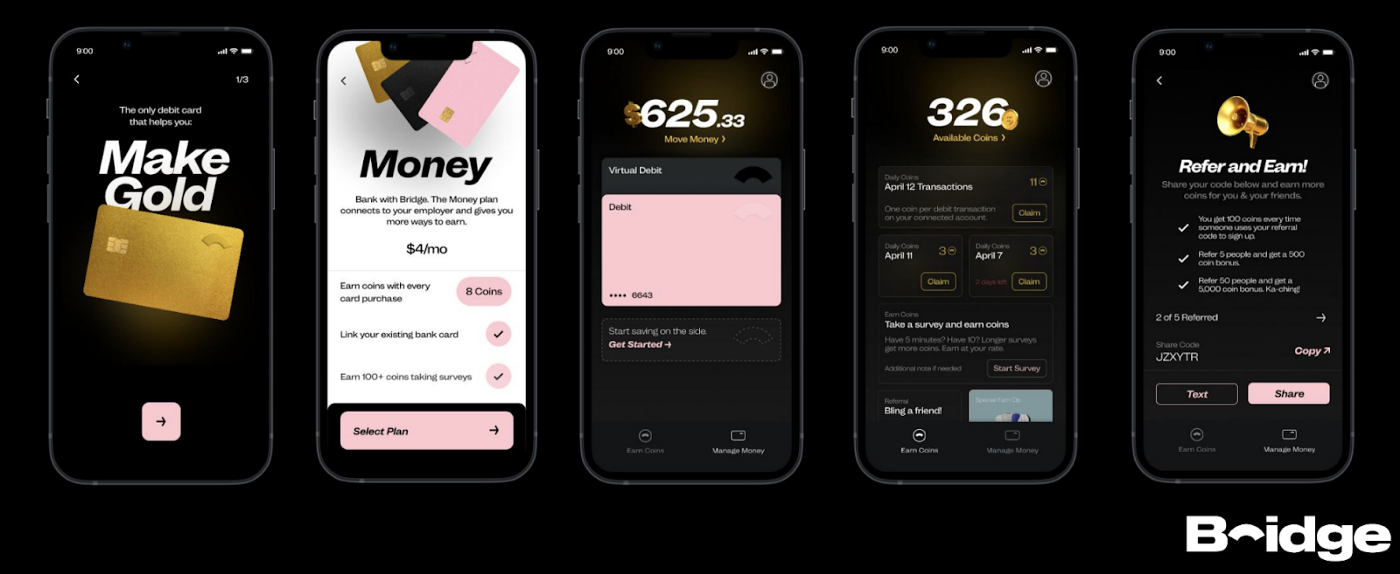

Meet Bridge, the mobile money app that helps you earn.

Driven from the Start

Raised in Atlanta to Indian immigrant parents, Lalit grew up in a middle-class family — his mother, a high school math teacher and the primary breadwinner. Looking back, Lalit cites the hard work and the struggles to maintain financial stability he observed in his youth as his core motivation for wanting to help others in a similar or worse position.

After finishing his undergraduate degree at Emory University, Lalit searched candidly for “the highest paying job I could find”, which led him to Wall Street where he began his career as a trader at Citigroup. With an initial focus on distressed consumer credit, he was able to obtain unique insight into the credit profile of low to middle income consumers and an understanding of how that fit into capital markets at large. For Lalit, this was a formative experience, and one where he grew tremendously; by the end four years, he had been promoted early and was co-managing $200M of firm capital.

However, during his time at Citigroup, Lalit started to think more about the work he was doing and his desire to create impact. Despite the comfort of a high-paying job on Wall Street, he felt an obligation to take a risk and build something that would make a tangible positive impact on the world. So… he quit.

New City, New Hustle

In 2018, Lalit left New York and moved to Chicago to be with his then-girlfriend, now-wife, who was in medical school. He arrived without any connections, job or plan, except that he knew he wanted to build something that would improve lives. He started reaching out cold to Chicago tech entrepreneurs who were engaging in impact-focused work, many of whom actually responded to the thoughtful outreach.

One meeting in particular stood out: it was with Brian Hill, founder and CEO of Edovo, an edtech startup working to improve the lives of those who are incarcerated. Lalit and Brian connected immediately and talked for hours in their first encounter, and by the end of their conversation, the two had agreed that Lalit would join Edovo as an Entrepreneur in Residence to identify a viable business model that would boost economic stability for Edovo’s customers and their families.

Bridge to Progress

Lalit dove into a ~6 month research period, during which he uncovered the original idea for Bridge: a digital bank account that would strip out all the fees typical of a prepaid debit card product often used by families of Edovo customers, with incredible mobile UX and outstanding customer service. Their initial audience: the ~15–20M people across the U.S. who use a prepaid debit card as their primary form of payment.

Though the product started with a banking focus, soon the Bridge team would discover insights from their members that transformed the vision into something much larger than a bank account.

“When we began asking deeper questions of our members regarding what they wanted in a financial product,” said Lalit, it turns out they weren’t really interested in ever more credit products. Their response was simple: “‘We’re living paycheck-to-paycheck. We just want more money.’” Bridge is listening.

The key unlock: while there is a proliferation of fintech companies helping lower income consumers improve their access to credit or banking (e.g. cash advance apps, neobanks, BNPL providers, credit-builder cards), there is remarkably little innovation centered on helping those same consumers maximize their income and earnings potential. This is where Bridge lives, or as Lalit refers to it, “boosting the asset side of the ledger.”

A Clear Value Proposition

Whether members are using their existing bank or banking with Bridge, the company exists to help their members make money, to be the “the money maker in your pocket.”

How It Works

Bridge has built a “rich marketplace of money-making opportunities” within their mobile app, some of which are funded by third parties seeking to obtain marketing or research insights from Bridge members on a fully anonymized basis.

Here’s an example: a Bridge member logs onto the app, agrees to take a survey — often feedback on retail products or experiences. The brand issuing the survey gets valuable customer sentiment data, and the Bridge member gets the lion’s share of the income generated from the survey. Everyone wins.

Other ways to earn within the app include: “extra cashback” on linked card purchases, voluntarily viewing ads, playing games, enrolling in no-loss raffles, referring friends and much more. Bridge has a debit card offering as well (powered by Unit and VISA) for those who want to upgrade their bank experience. To date, the most active Bridge members are earning upwards of $200 per month just by using the app.

But earning supplemental income, Lalit explains, is just the start.

Building a Wider Bridge

With Bridge, Lalit, his co-founder David Wright and their team have built a new onramp to wealth building, one that focuses on solving the root financial problem for 100M+ consumers in America: a lack of money. After all, savings and investing accounts are only helpful when you have something to save or invest. As the company evolves, Bridge plans to create more opportunities for their members to maximize their earning potential. Some products on their roadmap include: a feature to connect members with targeted, higher-paying job opportunities in their area, new ways to engage with brands beyond surveys, and more.

The end game? Build a brand that is synonymous with making money and improve upward economic mobility along the way.

On Risking It

We asked Lalit what advice he’d give to a first-time founder coming from the world of institutional finance. His insightful response: “The downside of taking a chance to go and build something on your own is never as great as it seems. The upside, however, is limitless.”

Written by Lucas Turner-Owens, Principal at TMV