Venture capitalist Soraya Darabi was on the way to San Francisco International Airport in 2018 when she got a phone call that stopped her in her tracks. The caller was Phil Wong, co-founder of Misfit Foods, which Darabi’s VC firm, TMV, had invested in earlier that year. Sales of the company’s cold-pressed juices weren’t hitting their targets. He’d decided it was time for a change.

“I knew it wasn’t going to be a quick conversation, so I dropped my bag, sat down on a bench in Union Square, and talked to Phil for two hours,” Darabi says.

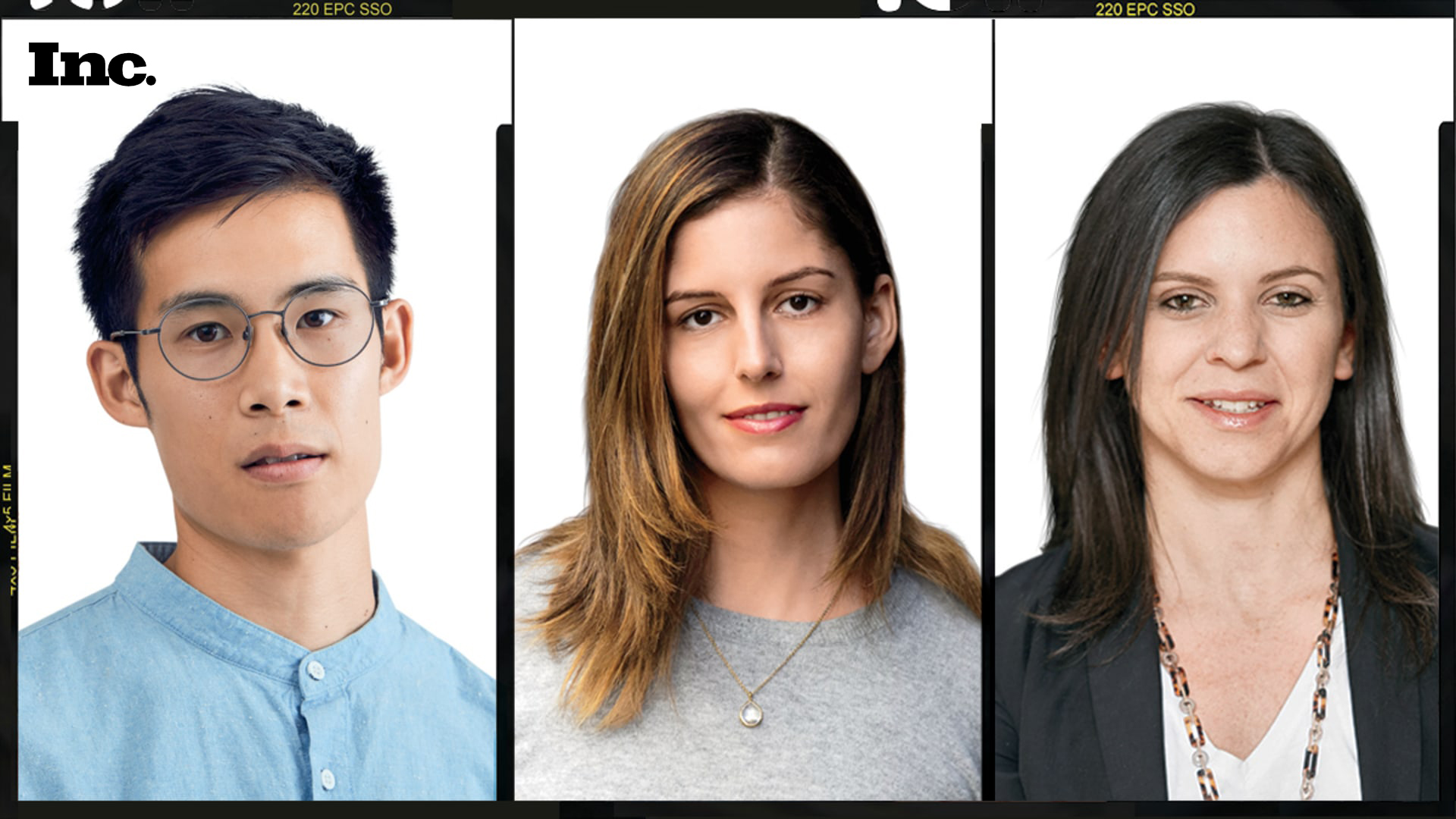

Wong’s idea was to make meat products partially from vegetables. It would be a hard pivot for the company, which had raised a $1 million seed round on the concept of making juices from leftover produce that farmers couldn’t sell. But Darabi was on board. (She also made her flight that day, just barely.) Over the next few months, she and her TMV co-founder, Marina Hadjipateras, guided Misfit Foods through the transition. The company doubled its revenue the next year, and today sells its combination veggie-and-meat items in Whole Foods and through online retailers like Fresh Direct.

“With another investor, it would have been a really hard conversation,” says Wong. “But TMV was so adamant that they were investing in us as individuals rather than in the concept, and that gave us the flexibility and freedom to make a pivot as drastic as this one.”

It is, after all, how Darabi and Hadjipateras operate. Consider: The co-founders named the firm TMV, for Trail Mix Ventures, because they agreed to only invest in entrepreneurs they’d want to “go on a journey in the woods with.” The firm puts a focus on purpose-driven companies, like parenting platform Tinyhood and Cityblock, a health care provider for underserved communities.

As an early-stage investor, TMV specializes in helping startups bring products to market, offering a deep bench of limited partners who can serve as mentors to entrepreneurs, including Wharton professor Adam Grant and former General Electric vice chair Beth Comstock.

Darabi and Hadjipateras are quick to unite portfolio companies, like when Misfit was considering switching to a direct-to-consumer model and TMV arranged a meeting between Wong and the founders of Smalls, a direct-to-consumer cat food company.

“They talked us through, in gruesome detail, what it would take for a business like ours to be a DTC-first business,” recalls Wong. The startup soon decided to offer its products on its website but to keep retailers its priority.

Before co-founding TMV in 2016, Hadjipateras helped lead the billion-dollar IPO of shipping company Dorian LPG, while Darabi co-founded several startups, including the restaurant app Foodspotting, which was acquired by OpenTable. “Marina brings acumen for being a good steward of capital and being a responsible fiduciary,” says Darabi, “whereas I’ve been in the entrepreneur’s shoes and have a high level of compassion for the experience.”

When Misfit’s Wong was invited to appear on Shark Tank earlier this year, Darabi knew she should connect him with other founders who had been on the show to help him prepare. Wong went on to earn a $300,000 deal with Mark Cuban and Kind founder Daniel Lubetzky. And when Wong needed more capital to fill out a recent funding round, TMV introduced him to an angel investor who quickly wrote a check. “We’re incredibly hands-on,” says Hadjipateras.

Still, nothing in Misfit Foods’ journey has been as critical as the pivot from juices to veggie-and-meat products–an assist that Wong won’t soon forget.

“Anybody can stick by you when things are going well,” says Wong. “But when the chips are down, that’s when you learn about your investors. Marina and Soraya stood by us. We wouldn’t be where we are without them.”

Written by Kevin J. Ryan, Staff Writer, INC.