Roughly half of Americans live paycheck to paycheck, without enough savings to handle even a $250 unexpected expense. And so when financial shocks occur, many of these households tap their retirement savings accounts (401(k), 403(b), IRA). Employers and employees alike want this to change, but remain at a standstill with ineffective, outdated systems and tools. TMV’s latest investment, Sunny Day Fund™ was built to bridge that gap, equipping companies with innovative financial benefits that enable employers to cultivate their employees’ financial well-being by helping them save for brighter days ahead. Result: a more productive, sustainable and healthy workforce.

Founded by CEO Sid Pailla, Sunny Day Fund falls squarely into TMV’s Financial Inclusion thesis, enabling equality in opportunity, access, and financial well-being for many Americans. Simply put, Sunny Day Fund is making saving easy, accessible and rewarding.

Sid’s Story

Sunny Day Fund was conceived from Sid’s personal experience. Born and raised in Hyderabad, India, Sid and his parents moved to the US to seek new opportunities. But that meant arriving in America with debt. When Sid’s parents lost their jobs in the dot-com bubble, they were left with no choice but to tap their retirement savings at the bottom of the market, a process that carries with it all sorts of penalties and taxes. That’s because 401(k) plans are simply not designed for emergency funding. Sid promised himself he’d never end up in a similar situation again, nor did he want other families to experience the anxiety of needing (and not having) money for necessary but unexpected expenses. So, Sid built a platform to help those with financial needs in the short term: employer-rewarded emergency savings or, as he calls it, a “sunny day fund” that’s there for you when, well, life happens.

Sounds simple, right? Not quite. There are multiple challenges when it comes to helping more households accumulate liquid savings that can be used for emergencies or unexpected expenses, from a leaky roof to a car that needs repair to the enormous impact of unemployment resulting from the pandemic.

The solution to all these challenges is a workplace emergency savings program that combines the advantages of a 401(k), like automatic paycheck deductions and employer contributions, with the accessibility of a savings bank account and a behavior-reinforcing user experience. It’s an appealing model for employees, since having separate rainy-day and retirement accounts can facilitate greater savings in both the short- and long-term by helping to segregate and catalyze two separate motivations to save.

How It Works

Sunny Day Fund is a new platform that offers workplace emergency savings programs and more. It enables employer-sponsored emergency and personal savings via FDIC-insured depository savings accounts — with a proprietary behavioral reward model. Depository institution accounts provide a liquid option that is not subject to ERISA and present a pathway to a portable no-cost solution for employees. These accounts are beneficial for many reasons: they provide safekeeping, immediate liquidity and a convenient digital payment system consisting of checks and electronic transfers. This model also avoids ERISA guidelines, which include minimum standards for participation, vesting, benefit accrual and funding, tenure requirements for eligibility, accumulation of benefits and more. (While ERISA can be beneficial in many scenarios, it was not designed for easy access to emergency funds).

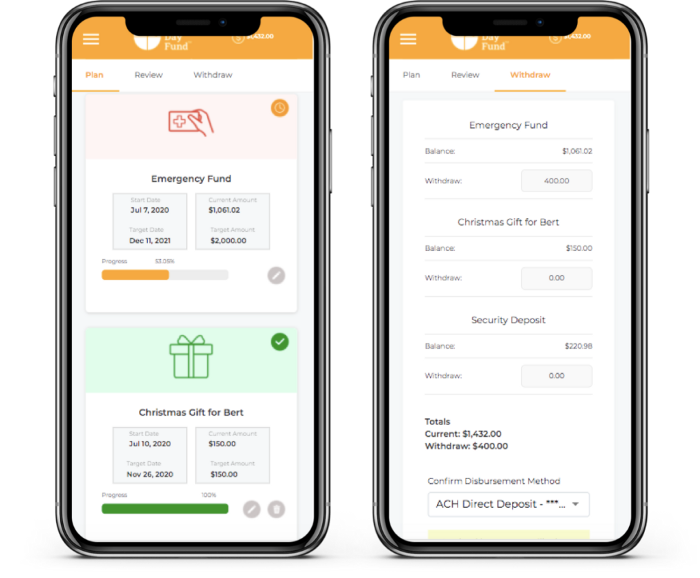

The beauty of Sunny Day Fund is that it simplifies saving so it becomes second-nature. The employee platform is intuitive, accessible and engaging, featuring a goal-based user experience, easy access, zero penalties, a secured or FDIC-insured account up to $250K, and access to helpful financial partners. Sunny Day Fund also executes and oversees the program on behalf of employers, making the overall experience seamless. Employers receive an easy-to-install and hyper-customizable platform, equipped with payroll setup, 256-bit security, complete regulatory compliance, program analytics and a full audit trail. And, it’s payroll-agnostic.

Let’s break it down:

- The employer establishes Sunny Day Fund in their organization, offering emergency savings as a benefit to their employees.

- Sunny Day Fund integrates with the employer’s payroll system to set up post-tax deductions for each individual employee.

- Those deductions are then sent to each employee’s brand new, standalone FDIC-insured savings account opened with one of Sunny Day Fund’s banking partners.

- Sunny Day Fund then automates all contributions from both the employer and employee: no decisions necessary, the savings contributions come straight out of the employee’s paycheck. And the rewards come quarterly.

- Employees may also set aside savings for numerous personal savings goals, (e.g. holiday gift funds, vacation savings). Sunny Day does mandate, however, that employees save towards an emergency savings fund goal with a target of $2K.

- Employees may withdraw at any time and without penalty; however, behavioral mechanisms like mental accounting and loss aversion help encourage employees to keep saving.

Sunny Days Ahead

According to the Federal Reserve Board, it is estimated that over 47% of the 152M working Americans do not have adequate savings to cover an emergency or financial hardship. This is clearly a tremendous challenge, which has only been exacerbated by the pandemic. Sunny Day Fund is ahead of the game in providing easy financial solutions that can be life-changing in the face of unexpected events. In fact, Congress is considering policies, protections and tax advantages for Emergency Savings Accounts (ESAs) similar to FSAs and HSAs for employer-sponsored emergency savings programs like Sunny Day Fund — supported in part by policy organizations including Employee Benefit Research Institute, Aspen Financial Security Program and AARP Policy Institute. Such policies could create a $15B market overnight for workplace emergency savings in America.

We asked Sid what advice he’d give to new founders. Here’s what he had to say: “Reflect as a team on your strengths and blind spots. Align on the big vision and the key results you need to hit. Develop your peer networks. Learn from mistakes, then let them go. Stay positive and connected!”

If you’re a founder changing the way that we live and work, we’d love to hear from you. Find us at hi@tmv.vc